With global economic uncertainty, inflation concerns, and rising geopolitical tensions, many investors are asking: Will gold mining stocks go up?

While no one can predict the future with certainty, several market trends and economic indicators suggest that gold mining stocks could see upward movement—especially if key conditions continue to unfold in their favor.

In this article, we’ll explore the factors influencing gold mining stocks and what investors should watch for in 2025 and beyond.

1. Rising Gold Prices Support Stock Gains

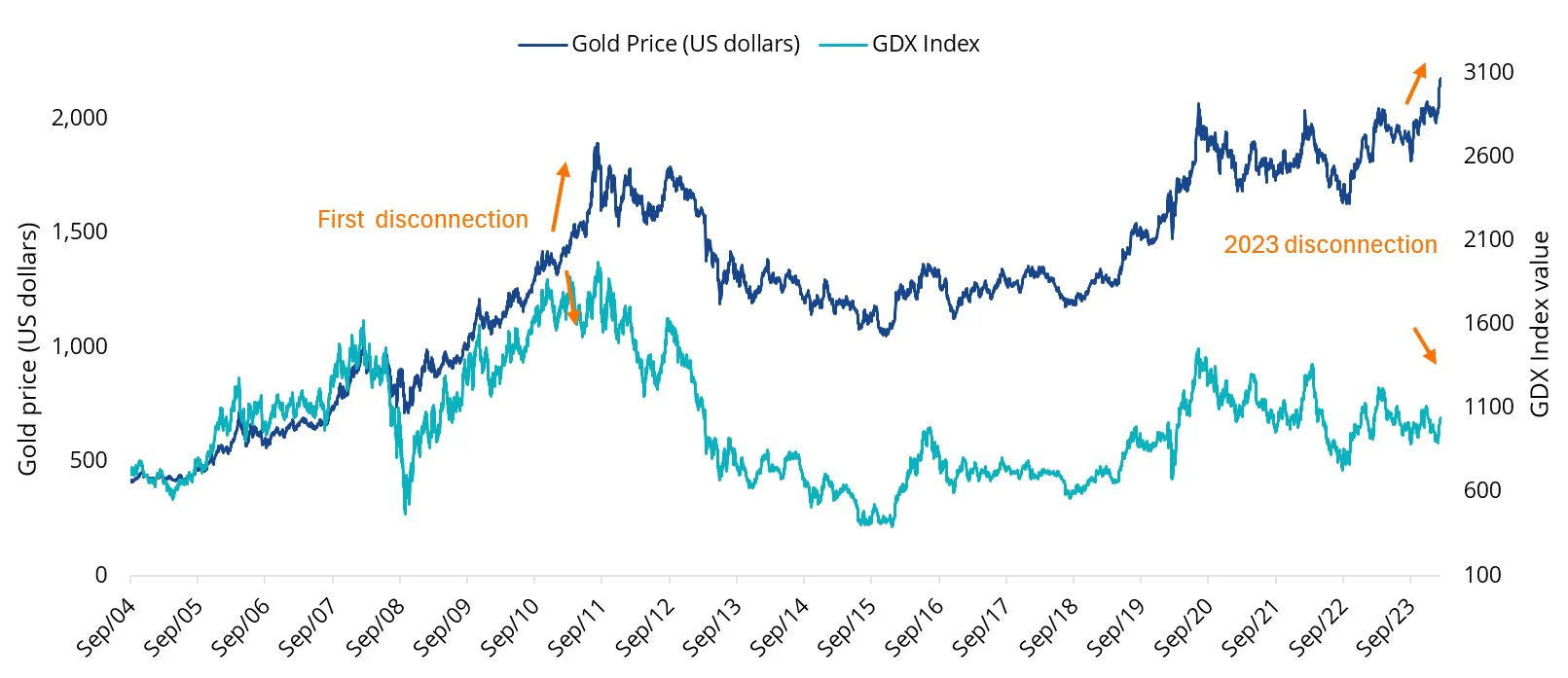

Historically, gold mining stocks tend to rise when gold prices increase —and often outpace them due to leverage.

Factors currently pushing gold prices higher include:

- Central bank buying

- Inflation fears

- Dollar weakness

- Geopolitical instability

If these trends continue, gold miners may benefit from improved margins and profitability.

2. Economic Uncertainty Boosts Demand for Safe-Haven Assets

During periods of:

- Market crashes

- Currency devaluation

- Rising interest rates (then falling again)

Investors often turn to gold as a safe-haven asset . This indirectly supports gold mining companies by increasing demand for their product and boosting investor confidence.

3. Interest Rate Cycles Influence Gold Performance

When central banks cut or pause interest rate hikes—especially the U.S. Federal Reserve—gold typically performs well.

Lower rates reduce the opportunity cost of holding non-yielding assets like gold, which in turn can lift both bullion prices and mining equities.

4. Company Fundamentals Are Improving

Many top-tier gold mining companies have:

- Reduced debt

- Improved operational efficiency

- Raised dividends

- Focused on high-grade, low-cost mines

Stronger fundamentals make these companies more resilient—and potentially more attractive to investors.

5. ETF Inflows and Institutional Buying

Institutional investors are increasingly allocating capital to:

- Gold-backed ETFs

- Mining-focused mutual funds

- Royalty and streaming companies

This trend reflects growing confidence in the sector and could fuel further gains in gold mining stocks.

FAQs

Q: Should I invest in gold mining stocks now?

A: It depends on your risk tolerance and investment goals. If you believe gold prices will rise and economic uncertainty persists, it could be a good time to consider exposure.

Q: Do gold mining stocks always go up when gold prices rise?

A: Not always—company-specific issues, production costs, and broader market trends can affect performance. However, rising gold prices generally support stronger stock performance.

Q: What are the risks of investing in gold mining stocks?

A: Risks include commodity price volatility, geopolitical instability in mining regions, environmental regulations, and poor management decisions.