Investing in gold mining stocks can be highly rewarding—but timing your entry is crucial. Unlike holding physical gold, mining stocks are influenced by both gold prices and company-specific factors.

In this article, we’ll explore when to buy gold mining stocks , what market conditions favor these investments, and how you can make informed decisions based on economic trends and industry performance.

1. During Economic Uncertainty or Geopolitical Tensions

Gold mining stocks often perform well during times of:

- Market volatility

- Currency devaluation

- Political instability

- Rising inflation

These conditions typically drive up the price of gold , which boosts revenues for mining companies—often leading to higher stock prices.

2. When Interest Rates Are Low or Falling

Central banks lowering interest rates usually signals economic stimulus, which can weaken currencies and increase demand for gold as a safe asset.

This environment is favorable for:

- Gold miners’ profitability

- Easier access to financing

- Lower operational costs

Watch for central bank policies before making a move.

3. During a Bull Market in Gold

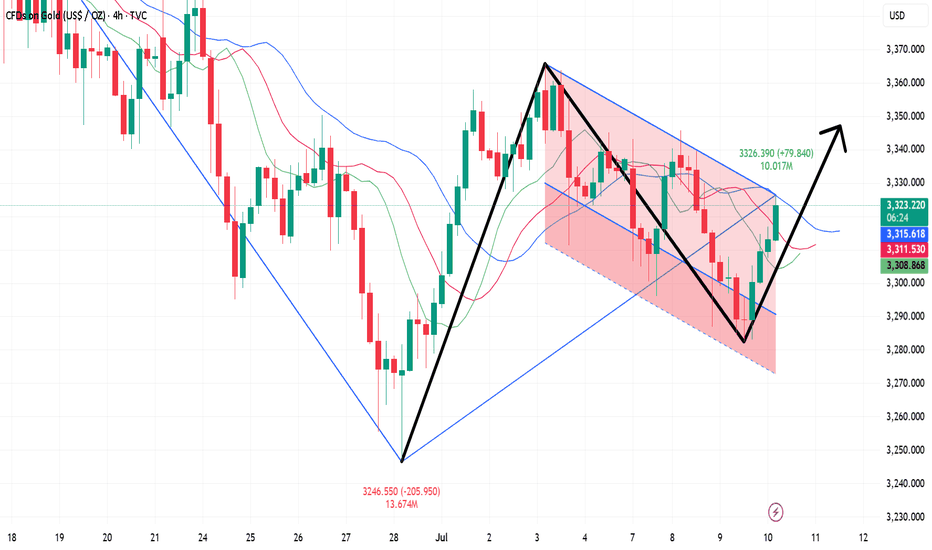

The best time to buy gold mining stocks is often when gold itself is in an uptrend . Since mining stocks are leveraged to gold prices, they tend to rise even faster than the metal itself during bull runs.

Look for:

- Breakouts above long-term resistance levels

- Rising global demand (especially from central banks)

- Increasing ETF holdings in gold

4. After a Market Correction or Downturn

Gold mining stocks can be volatile and may fall sharply after a rally. Buying during a correction allows investors to:

- Acquire shares at discounted prices

- Benefit from potential rebounds

- Build positions before the next bull cycle

Use technical indicators like moving averages and RSI to identify oversold conditions.

5. When Company Fundamentals Improve

Sometimes, it’s not just the macro environment—it’s the health of the individual company. Consider buying when:

- A company reduces debt

- Production costs decline

- Management improves

- New reserves are discovered or acquired

Strong fundamentals can make a difference, even if gold prices are flat.

FAQs

Q: Should I buy gold mining stocks when gold prices are high?

A: Not necessarily—timing matters. If gold has already had a big run-up, look for pullbacks or undervalued miners instead of chasing highs.

Q: What are the best months to buy gold mining stocks?

A: Historically, gold tends to perform well from September to December , but always analyze current market conditions rather than relying solely on seasonal trends.

Q: Are gold mining stocks a good hedge against inflation?

A: Yes, especially when inflation is rising and real interest rates are falling. However, their performance also depends on company management and operational efficiency.