1. Exploration: Finding the Gold

Before any mining begins, companies must locate viable gold deposits — often in remote or geologically complex areas.

Costs Involved:

- Geological surveys : $50,000–$500,000+

- Drilling programs : $1M–$10M+ per project

- Permitting & legal fees : Varies by country

🔍 This phase can take years and often ends without finding economically viable ore.

2. Mine Development: Building the Infrastructure

Once a deposit is confirmed, companies begin developing the mine site — building roads, processing plants, and worker housing.

Average Development Costs:

- Open-pit mines: $50M–$500M

- Underground mines: $100M–$1B+

- Includes permits, engineering, and construction

📍 Remote locations add significantly to these costs due to transportation and logistics.

3. Mining Operations: Extraction and Processing

This is where the actual gold is extracted using either open-pit , underground , or placer mining methods.

Operational Cost Breakdown (per ounce of gold produced):

| Cost Category | Estimated Cost (USD) |

|---|---|

| Labor | $100–$300/oz |

| Equipment & Fuel | $50–$200/oz |

| Ore Processing | $100–$400/oz |

| Environmental Compliance | $50–$150/oz |

| Royalties & Taxes | $50–$200/oz |

| Total Avg. Cost | $350–$1,200/oz |

4. Closure and Reclamation: Restoring the Land

At the end of a mine’s life, companies are required to restore the land to a safe and environmentally acceptable state.

Typical Reclamation Costs:

- $5M–$50M per mine

- May include water treatment systems, reforestation, and tailings management

These costs are often set aside over the life of the mine through reclamation bonds or funds .

Factors That Affect Mining Costs

Several variables influence how much it costs to mine gold:

1. Location

- Mines in politically stable countries (e.g., Canada, Australia) may have higher labor costs but lower political risk.

- Mines in unstable regions may face security issues, higher taxes, or sudden regulatory changes.

2. Mine Type

- Open-pit mining : Cheaper per ounce, but requires large-scale operations.

- Underground mining : More expensive due to safety and complexity.

- Placer mining : Lower capital costs, but limited yields.

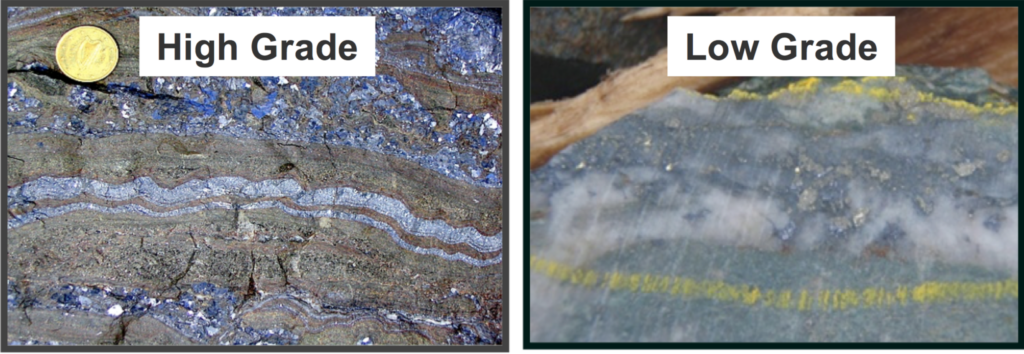

3. Grade of Ore

- High-grade ores yield more gold per tonne, reducing overall costs.

- Low-grade ores require processing massive volumes, increasing energy and chemical use.

4. Environmental Regulations

- Stricter rules mean higher costs for waste management, emissions control, and water treatment.

Global Examples of Mining Costs

| Country | Avg. All-in Sustaining Cost (AISC) | Notes |

|---|---|---|

| Australia | $1,200–$1,500/oz | High labor and energy costs |

| Canada | $1,100–$1,400/oz | Strong environmental laws |

| Ghana | $900–$1,200/oz | Political risks increase insurance costs |

| Russia | $800–$1,000/oz | Cold climate adds to operating costs |

| Peru | $950–$1,100/oz | Community relations impact timelines |

Final Thoughts

Mining gold is a capital-intensive, high-risk, and highly regulated industry. While gold prices fluctuate, cost control is critical for profitability.

As demand for sustainable and ethical sourcing grows, mining companies must also invest in green technologies , community engagement , and responsible practices — all of which add to the bottom line.

Understanding the full scope of gold mining costs helps investors, policymakers, and consumers appreciate the real value behind every ounce of gold.

FAQs

Q1: How much does it cost to mine one ounce of gold?

On average, it costs between $350 and $1,200 per ounce , depending on location, ore grade, and operational efficiency.

Q2: What is the “all-in sustaining cost” (AISC)?

AISC includes all direct and indirect costs needed to maintain ongoing mining operations, such as labor, fuel, processing, royalties, and sustaining capital.

Q3: Why is underground gold mining more expensive?

Underground mining involves greater safety measures, ventilation, support structures, and equipment, making it more costly than surface mining.

Q4: Can small-scale miners compete with big companies?

Small-scale operations can be profitable in high-grade zones, but they often lack access to capital, technology, and markets that larger firms enjoy.

Q5: Does gold price cover mining costs?

Not always. When gold prices drop below the all-in cost , many mines become unprofitable and may shut down temporarily or permanently.