If you’re asking, “How buy gold fidelity?” , you’re likely referring to investing in gold through Fidelity Investments , one of the largest and most trusted financial services providers in the U.S. While Fidelity doesn’t sell physical gold directly, they offer several smart ways to invest in gold , including ETFs, mutual funds, and mining stocks.

1. Can You Buy Physical Gold on Fidelity?

Fidelity does not offer direct purchase of physical gold bullion or coins like some other platforms (e.g., APMEX or JM Bullion). However, it provides multiple indirect ways to gain exposure to gold , which can be more convenient and liquid for many investors.

2. Step-by-Step: How to Buy Gold on Fidelity

Here’s how to invest in gold via Fidelity:

- Log in to Your Fidelity Account – Or open one if you don’t have one already.

- Search for Gold Investment Options – Like GLD, IAU, or gold-related stocks.

- Review Fund Details – Check expense ratios, performance, and holdings.

- Place a Trade – Choose between market order or limit order.

- Monitor Your Investment – Track returns and adjust your portfolio as needed.

Fidelity offers zero-commission trading on most ETFs and stocks, making it cost-effective.

3. Top Gold Investment Options on Fidelity

Here are some of the best gold investments available on Fidelity :

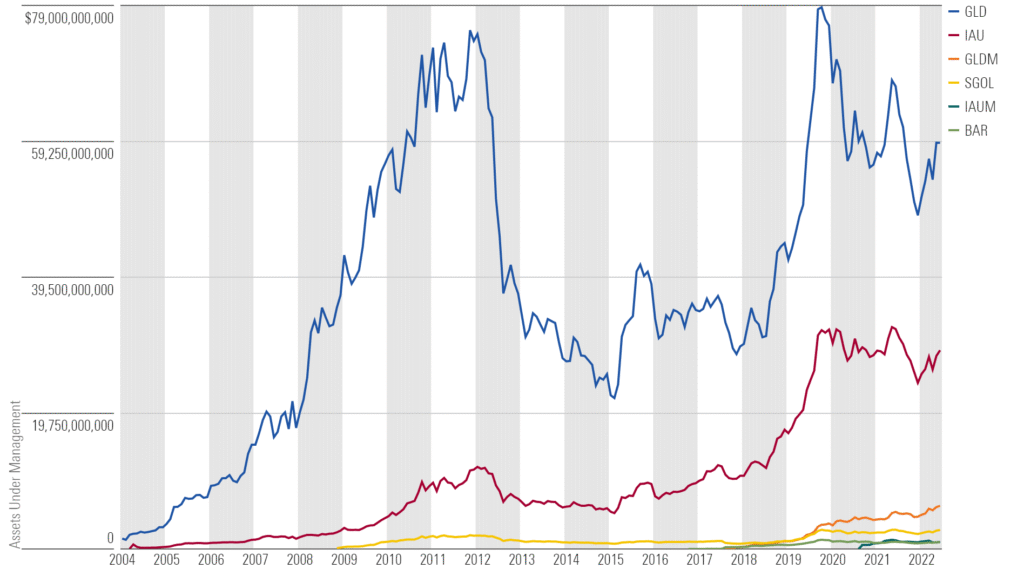

| SPDR Gold Shares (GLD) | Gold ETF | Tracks price of gold bullion; largest gold ETF |

| iShares Gold Trust (IAU) | Gold ETF | Lower expense ratio than GLD; good for long-term |

| VanEck Gold Miners ETF (GDX) | Mining Stocks ETF | Invests in global gold mining companies |

| Newmont Corporation (NEM) | Individual Mining Stock | Largest gold producer in the world |

These allow you to benefit from gold price movements without owning physical metal.

4. Benefits of Buying Gold on Fidelity

Why consider Fidelity for gold investment?

- ✅ No Storage Hassles – No need to store or insure physical gold

- ✅ Zero Commission Trading – On most ETFs and stocks

- ✅ Diversification Options – Combine gold with other assets

- ✅ Research Tools & Insights – From Fidelity experts

- ✅ Retirement Account Compatibility – Can hold gold ETFs in IRAs

5. Things to Consider Before Investing

Before buying gold on Fidelity:

- ⚠️ Understand that gold ETFs do not give ownership of physical gold

- ⚠️ Review expense ratios and tracking errors of ETFs

- ⚠️ Know the tax implications – short-term gains taxed at ordinary income rates

- ⚠️ Monitor market trends and inflation expectations

- ⚠️ Avoid emotional investing—use dollar-cost averaging for better results

Frequently Asked Questions (FAQs)

Q1: Does Fidelity sell physical gold bars or coins?

A: No, Fidelity does not offer direct purchases of physical gold bullion or coins.

Q2: What is the best gold ETF on Fidelity?

A: Popular options include GLD and IAU , both tracking the price of gold bullion.

Q3: Can I hold gold ETFs in my Fidelity IRA?

A: Yes, many gold ETFs are eligible for inclusion in Fidelity Roth or Traditional IRAs .

Conclusion

While Fidelity doesn’t sell physical gold, it offers smart and secure ways to invest in gold through ETFs and mining stocks—making it ideal for modern investors.