If you’re asking, “How buy gold bars?” , you’re likely looking for a safe and tangible way to invest in gold. Gold bars are one of the most popular forms of physical gold investment—offering purity, portability, and value .

In this guide, we’ll walk you through the complete process of buying gold bars in India, including where to buy them, what to look for, and how to ensure authenticity.

1. What Are Gold Bars?

Gold bars are rectangular-shaped pieces of refined gold, typically available in various weights like 1 gram, 5 grams, 10 grams, 50 grams, and 100 grams . They come with hallmark certifications and are issued by recognized refiners or banks.

They are ideal for investors who want to own pure gold (usually 99.5% to 99.99%) without the added cost of making charges found in jewelry.

2. Step-by-Step: How to Buy Gold Bars

Here’s how to buy gold bars in India:

- Choose a Trusted Seller – Reputed brands include MMTC-PAMP, SBI Gold, HDFC Gold, and UBS Gold.

- Select Weight & Purity – Decide on the size that fits your budget and investment goal.

- Buy Online or In Store –

- Online : Via platforms like Amazon India, Flipkart, MMTC-PAMP India, or bank portals .

- Offline : At select bank branches or authorized jewelers.

- Verify Authenticity – Ensure each bar has a certificate of purity, serial number, and tamper-proof packaging .

- Make Payment – Use UPI, card, net banking, or cash (for offline purchases).

- Get Delivered or Collect – Home delivery is available, but some high-value purchases may require in-person collection.

3. Best Places to Buy Gold Bars in India

Here are some of the most trusted sources to buy gold bars:

| MMTC-PAMP | mmtcpamp.com | 99.99% pure, BIS hallmarked, global brand |

| SBI Gold | SBI Branches / Partner Stores | Secure, government-backed |

| HDFC Gold | HDFC Bank Branches | Verified quality, easy buyback |

| Amazon India | amazon.in | Easy delivery, customer reviews |

| Flipkart | flipkart.com | Competitive pricing, assured delivery |

Always verify the seller’s BIS certification and read reviews before purchasing.

4. Things to Consider Before Buying Gold Bars

Before investing in gold bars, keep these factors in mind:

- ✅ Purity Certification – Look for BIS hallmarking or LBMA certification

- ✅ Price vs Market Rate – Compare live gold prices before buying

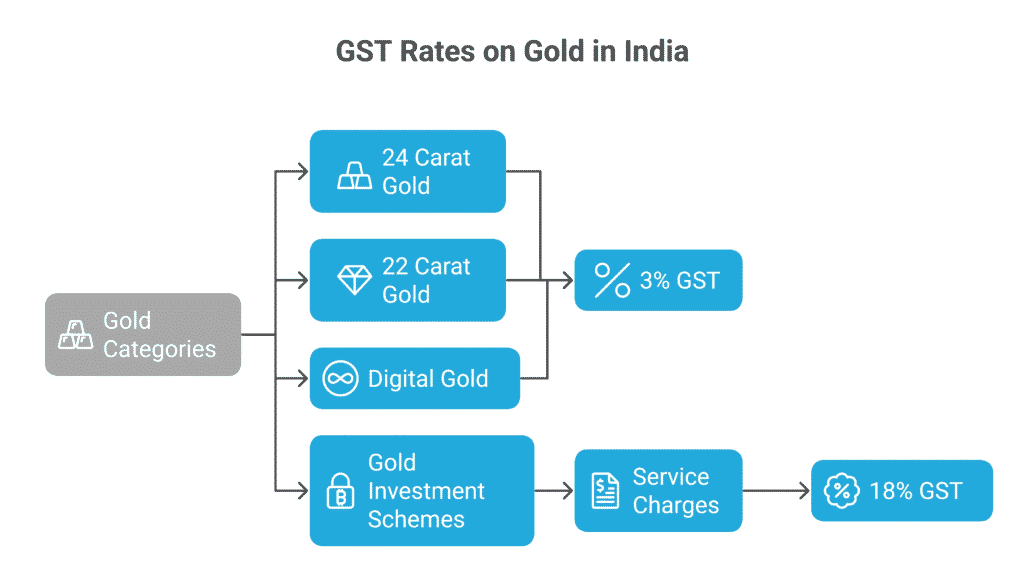

- ✅ GST Charges – A 3% GST applies to gold bars

- ✅ Storage Options – Keep in a safe or locker to avoid theft

- ✅ Buyback Policy – Check if the seller offers resale or buyback support

5. Benefits of Investing in Gold Bars

Why choose gold bars over other forms of gold?

- ✅ High Purity – Close to 99.99% gold content

- ✅ Easy to Sell – Most banks and jewelers offer buyback

- ✅ No Making Charges – Unlike jewelry

- ✅ Good for Long-Term Investment

- ✅ Portable Wealth – Can be stored and transported easily

Frequently Asked Questions (FAQs)

Q1: Is it safe to buy gold bars online?

A: Yes, as long as you buy from trusted and certified sellers like MMTC-PAMP or bank-backed portals.

Q2: Do I have to pay GST on gold bars?

A: Yes, a 3% GST is applicable on the purchase of gold bars in India.

Q3: Can I sell gold bars back to the bank?

A: Some banks like SBI and HDFC offer buyback facilities, but policies vary by institution.

Conclusion

Buying gold bars is a secure and valuable way to invest in gold—offering high purity, ease of ownership, and long-term returns when done wisely.