South Africa has long been synonymous with gold. For decades, it was the world’s top gold producer , and while its output has declined over time, the country still holds vast gold reserves that continue to play a crucial role in its economy and the global gold market.

Overview of South Africa’s Gold Reserves

According to recent data from the U.S. Geological Survey (USGS) and the South African Department of Mineral Resources and Energy , South Africa holds approximately:

6,000 metric tons of gold reserves

This places South Africa among the top 10 countries globally in terms of proven gold reserves, behind only nations like Australia, Russia, and the United States.

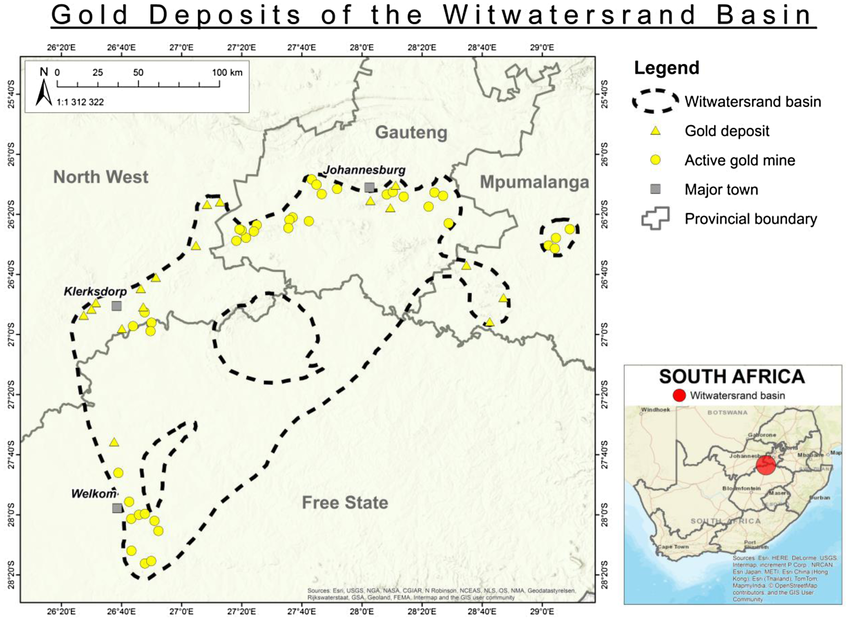

The vast majority of these reserves are found in the Witwatersrand Basin , a geological formation that stretches across Gauteng, North West, and Free State provinces.

The Witwatersrand Basin: Heart of South Africa’s Gold Wealth

The Witwatersrand Basin is one of the most significant gold-bearing regions in the world. Discovered in 1886, this basin contains about half of the world’s known gold reserves , making it the largest single repository of mineable gold.

Key features of the Witwatersrand:

- Contains reef-type gold deposits embedded in ancient sedimentary rock

- Mines can reach depths of over 4,000 meters

- Has produced more than 50,000 metric tons of gold since the late 19th century — nearly 40% of all gold ever mined

Despite declining production rates due to aging infrastructure and rising costs, the deep-level potential of the basin continues to attract exploration interest.

Current Gold Production vs. Reserves

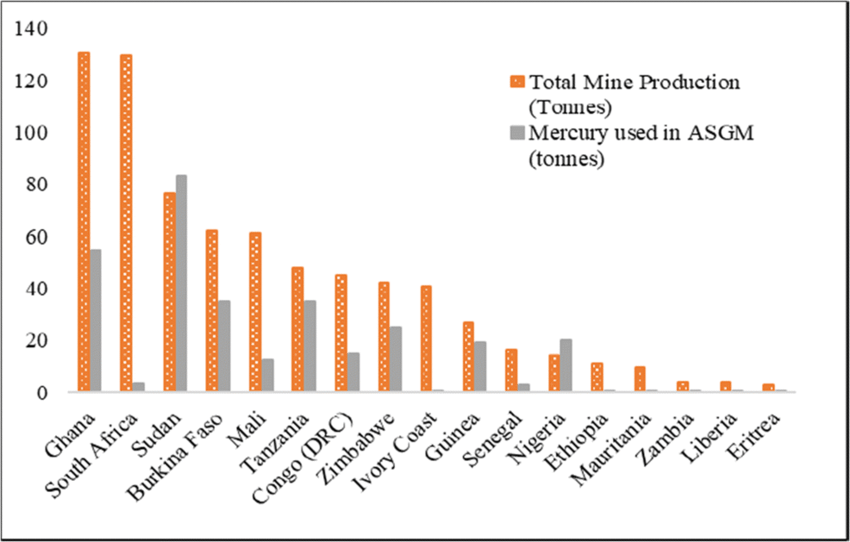

Although South Africa once accounted for nearly 75% of global gold output , today it ranks sixth or seventh behind countries like China, Australia, and Russia.

Current annual production averages around 90–100 tonnes per year , a fraction of its peak in the 1970s when output exceeded 1,000 tonnes annually .

However, large reserves remain untapped due to:

- High operational costs

- Technical challenges of ultra-deep mining

- Power supply issues (e.g., load-shedding)

- Regulatory and labor complexities

Experts believe that with new investment, technology, and government support, South Africa could re-emerge as a stronger player in the gold industry.

Major Companies Holding Gold Reserves

Several key mining companies control the bulk of South Africa’s gold reserves:

| Company | Key Operations | Notable Mines |

|---|---|---|

| AngloGold Ashanti | Mponeng, TauTona, Kopanang | Some of the deepest mines in the world |

| Sibanye-Stillwater | Driefontein, Kloof, Beatrix | Focused on revitalizing old operations |

| Harmony Gold | Savuka, Doornfontein, Moab Khotsong | Known for deep-level extraction |

| Gold Fields | South Deep Mine | One of the largest undeveloped gold resources |

These companies continue to explore for deep extensions and invest in automation and safety improvements to make mining more sustainable.

Frequently Asked Questions (FAQs)

Q: How much gold does South Africa have left?

A: South Africa is estimated to have around 6,000 metric tons of proven gold reserves, primarily located in the Witwatersrand Basin.

Q: Is South Africa still rich in gold?

A: Yes, despite declining production, South Africa remains one of the top 10 countries in gold reserves globally.

Q: Why has gold production in South Africa declined?

A: Due to aging mines, high operational costs, power shortages, and increasing depth of mining operations.

Q: Can South Africa increase its gold production again?

A: With new investments, technological upgrades, and policy reforms, there is potential for growth, especially in underdeveloped areas.

Q: Who owns the gold reserves in South Africa?

A: They are controlled by major mining firms like AngloGold Ashanti, Sibanye-Stillwater, Harmony Gold, and Gold Fields.

Conclusion

South Africa’s gold reserves represent not just a natural resource but a legacy of economic transformation, industrial innovation, and global influence in the gold market.