Gold is a highly valued asset across Africa and the Middle East, with prices influenced by global markets, local economies, and trade dynamics. While gold prices in Africa vary by country, Dubai serves as a major global gold trading hub, offering competitive pricing due to its tax-free status and strong infrastructure.

Understanding how gold prices compare between these regions can help investors, traders, and buyers make informed decisions.

1. Global Gold Pricing – The Benchmark

The global price of gold is set on international exchanges like:

- LBMA (London Bullion Market Association)

- COMEX (New York)

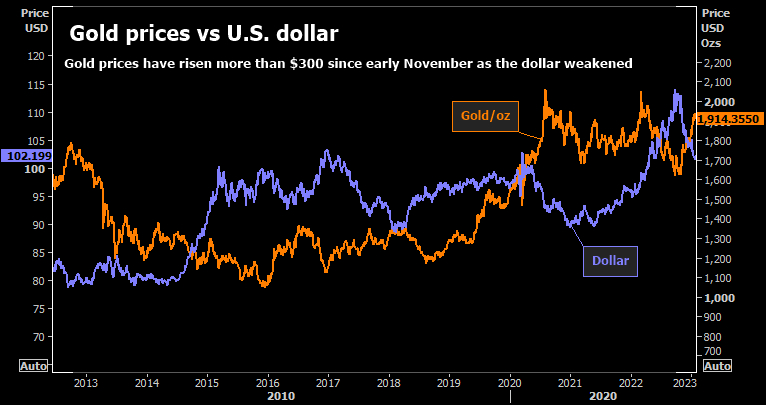

Prices are quoted per troy ounce in US dollars and fluctuate daily based on demand, inflation, geopolitical events, and currency strength.

As of 2025, gold typically trades between $2,300 and $2,400 per ounce, forming the base price for all countries.

2. Gold Price in Africa – Country Variations

In Africa, gold prices depend on:

- Exchange rates (USD to local currency)

- Import duties and taxes

- Local dealer premiums

- Market demand

Top African Markets:

- South Africa: Prices follow the Rand value of gold; Krugerrands are popular.

- Nigeria: High demand for bullion and jewelry, priced in Naira.

- Kenya & Tanzania: Local dealers adjust prices based on daily USD exchange rates.

- Ghana & Uganda: Growing gold investment market with rising retail interest.

📌 Note: African countries often see higher consumer prices due to import costs and limited large-scale refining.

3. Gold Price in Dubai – A Global Gold Trading Hub

Dubai is one of the world’s leading centers for gold trade and investment because of:

- Tax-free imports

- Strong regulatory oversight

- High liquidity

- Proximity to Asian and European markets

Gold prices in Dubai are usually very close to the international spot price, making it an attractive destination for bulk buyers and investors.

Gold souks and modern malls like the Dubai Gold Souk and Damascus Gate offer transparent pricing and certified products.

4. Key Differences – Africa vs. Dubai

| Feature | Africa | Dubai |

|---|---|---|

| Pricing | Based on USD/local currency exchange rate | Close to international spot price |

| Taxes | May include VAT or import duties | Zero VAT on gold (as of current UAE policy) |

| Buying Options | Coins, bars, jewelry | Coins, bars, jewelry, gold biscuits |

| Market Size | Smaller retail-driven market | Large wholesale and retail market |

| Refineries | Limited domestic refining | Home to major refineries like Umicore and Valcambi |

5. Factors Influencing Gold Buying Decisions

When comparing gold prices between Africa and Dubai, consider:

- Exchange rate fluctuations

- Travel and transport costs

- Certification and purity standards

- Security and authenticity

- Investment goals (short-term vs. long-term)

For large purchases, buying in Dubai may offer better value. For regular small investments, local African markets provide convenience and accessibility.

Frequently Asked Questions (FAQ)

Q: Is gold cheaper in Dubai than in Africa?

A: Yes, Dubai typically offers lower premiums due to tax-free policies and proximity to major suppliers.

Q: Can I buy gold in Dubai and bring it to Africa?

A: Yes, but be aware of customs limits and declaration rules in your home country.

Q: How does the Rand or Naira affect gold prices in Africa?

A: A weaker local currency increases the cost of imported gold, raising prices for consumers.

Final Thoughts

While the gold price in Africa is closely tied to the global market, regional factors like exchange rates and taxes influence final retail prices. Dubai remains a top choice for cost-effective gold purchases, especially for larger investors.

Whether you’re buying in Africa or Dubai, staying updated on gold prices and understanding market conditions will help maximize your investment returns.