With rising gold prices, many people wonder: Can I buy gold on EMI? The good news is—yes, you can! Whether it’s gold jewelry, coins, or digital gold, several financial institutions and retailers now offer EMI (Equated Monthly Installment) options to make gold purchases more affordable and accessible.

Let’s explore how buying gold on EMI works and what you should know before making such a purchase.

1. Yes, You Can Buy Physical Gold on EMI

Most leading jewelry stores like Tanishq, Kalyan Jewellers, Malabar Gold & Diamonds , and others partner with banks and financial institutions to allow customers to buy physical gold using EMIs. This includes:

- Gold jewelry

- Coins and bars

- Gold schemes with installment plans

You can use your credit card or personal loan to split the cost into manageable monthly payments.

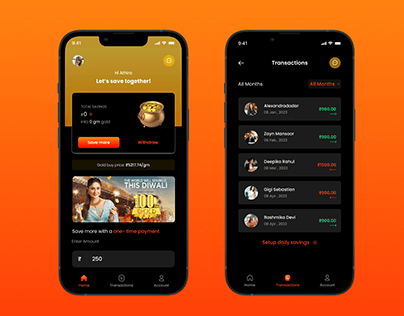

2. Digital Gold Platforms Also Offer EMI Options

Platforms like Paytm Gold, PhonePe Gold, and Google Pay Gold let you invest in digital gold starting from as low as ₹1. Some of these platforms now provide loan or credit features that function similarly to EMIs for larger gold investments.

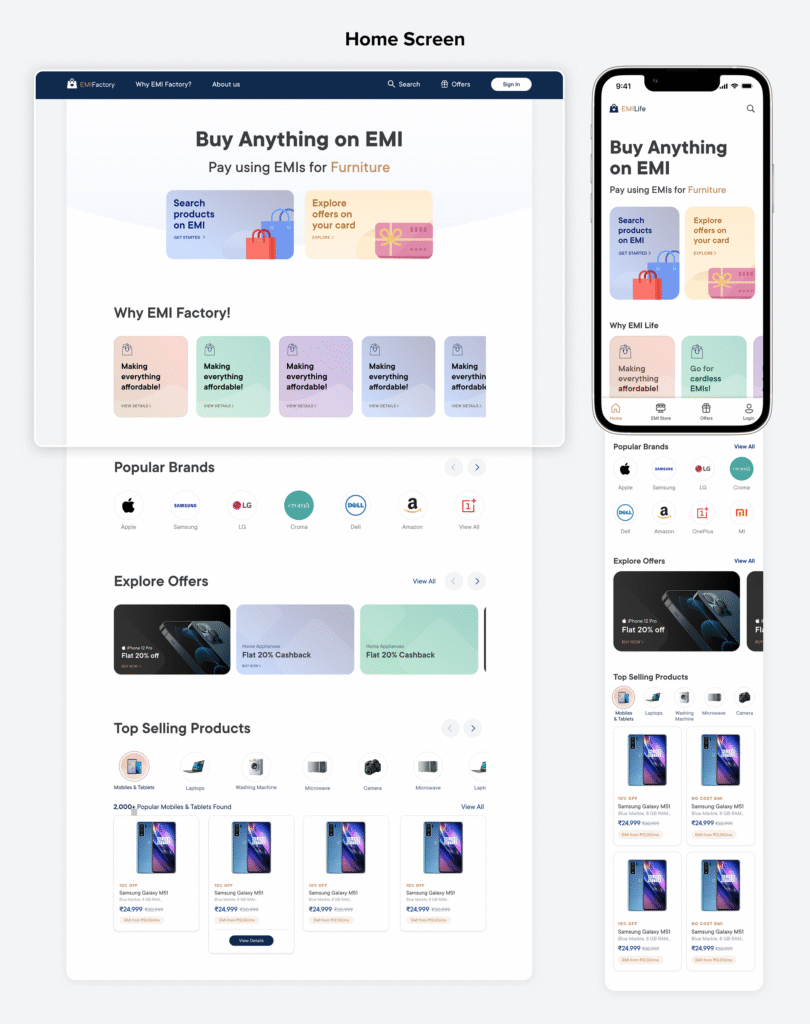

3. How Buying Gold on EMI Works

Here’s a quick breakdown of the process:

- Choose the gold item or investment amount

- Select the EMI payment option at checkout

- Choose your preferred tenure (3 months to 24 months)

- Complete KYC and verification if required

- Start paying monthly installments

Interest rates and processing fees may apply depending on the provider.

4. Benefits of Buying Gold on EMI

- Affordable Payments: Break down large purchases into smaller installments

- No Delayed Gifting: Ideal for weddings, festivals, and gifting occasions

- Convenient Access: Buy gold even if you don’t have full funds upfront

- Flexible Tenure: Choose from 3 to 24-month plans

5. Things to Consider Before Buying Gold on EMI

Before opting for EMI:

- Check interest rates and hidden charges

- Confirm if pre-closure or missed payment penalties apply

- Ensure the seller or platform is reliable and trusted

- Compare offers across banks and jewelers

Frequently Asked Questions (FAQs)

Q1: Is there zero-interest EMI on gold purchases?

A: Some jewelers and banks offer limited-period zero-interest EMI schemes during festivals or promotions.

Q2: Can I buy 24-carat gold on EMI?

A: Yes, most gold products including 24K gold jewelry, coins, and bars are available on EMI.

Q3: Does buying gold on EMI affect my credit score?

A: Yes, timely payments can improve your credit score, while defaults may harm it.

Conclusion

Buying gold on EMI is not only possible but also a convenient way to own gold without straining your finances.