In times of economic uncertainty, market volatility, and rising inflation, more investors are turning to gold and silver as a reliable way to preserve wealth and protect assets. But why buy gold and silver when there are so many other investment options available?

1. Hedge Against Inflation

One of the most compelling reasons to invest in gold and silver is their proven ability to protect purchasing power during inflationary periods .

When fiat currencies lose value due to rising prices or excessive money printing by governments, gold and silver tend to hold or increase in value , making them ideal for:

- Preserving savings

- Protecting retirement funds

- Shielding against currency devaluation

Historically, both metals have shown strong performance during inflationary spikes—making them essential tools for long-term wealth protection .

2. Safe-Haven Assets in Times of Crisis

Gold and silver are widely regarded as safe-haven investments during economic downturns, geopolitical conflicts, and stock market crashes.

During events like:

- Financial recessions

- Political instability

- Stock market crashes

Investors often flee to gold and silver because they’re tangible, scarce, and universally valued —offering stability when other asset classes falter.

3. Portfolio Diversification

A well-balanced investment portfolio includes assets that respond differently to market conditions. Adding gold and silver can help reduce overall risk by:

- Lowering exposure to volatile equities

- Balancing bond-heavy portfolios

- Providing liquidity in uncertain markets

Because precious metals often move inversely to stocks and currencies , they act as a stabilizing force—especially during unpredictable economic cycles.

4. Scarcity and Long-Term Value

Unlike paper assets or digital currencies, gold and silver are finite resources . Mining new supplies becomes increasingly difficult and costly over time.

This limited supply, combined with growing demand from:

- Investors

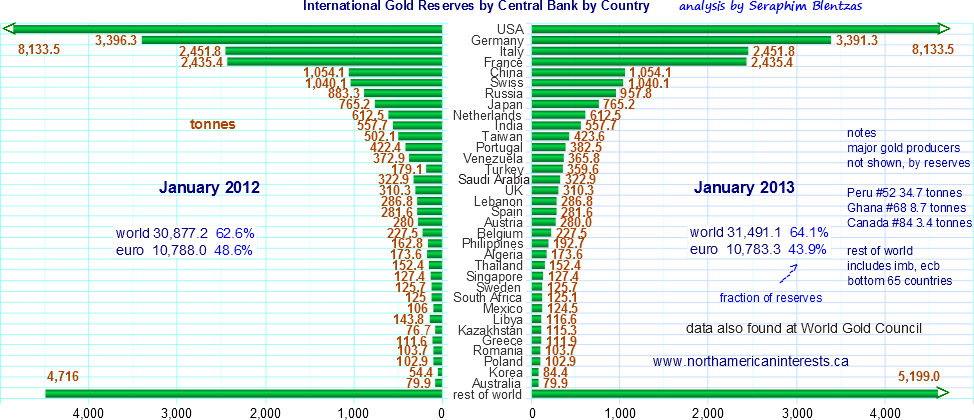

- Central banks

- Industrial sectors (especially for silver)

supports long-term appreciation in value—making physical precious metals a solid store of wealth.

5. Protection Against Currency Devaluation

As governments continue quantitative easing and print more money, the value of national currencies declines . Gold and silver act as a natural safeguard against this erosion of value.

They are not tied to any one government or economy, meaning they retain intrinsic worth regardless of political or monetary policy changes.

Frequently Asked Questions (FAQs)

Q1: Is it better to buy gold or silver?

It depends on your goals. Gold is more stable and widely accepted as a reserve asset, while silver is more affordable and has greater industrial use—offering higher growth potential.

Q2: Can I buy gold and silver for my IRA?

Yes, you can invest in IRS-approved gold and silver coins or bars through a self-directed precious metals IRA, allowing tax-advantaged growth.

Q3: How much of my portfolio should be in gold and silver?

Most financial advisors recommend allocating 5–15% to precious metals , depending on your risk tolerance, financial goals, and market outlook.

Whether you’re looking to hedge inflation , diversify your portfolio , or simply own something tangible and timeless, buying gold and silver makes sense for today’s investor.