If you’re asking, “How buy Gold BeES?” , you’re likely looking to invest in one of India’s most popular gold exchange-traded funds (ETFs) . Gold BeES , offered by Benchmark Asset Management Company , is a gold ETF that gives investors digital exposure to physical gold without the hassles of storing it.

1. What Is Gold BeES?

Gold BeES is an Exchange Traded Fund (ETF) that tracks the price of domestic gold and is listed on the National Stock Exchange (NSE) . Each unit typically represents 1 gram of gold , making it easy for investors to buy small or large quantities.

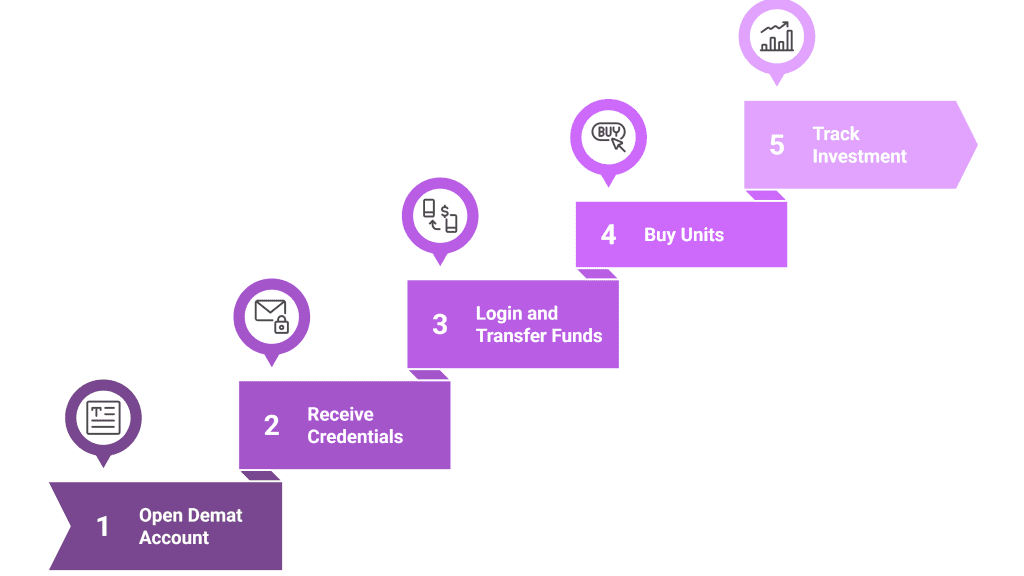

2. Step-by-Step: How to Buy Gold BeES

Here’s how to invest in Gold BeES:

- Open a Demat and Trading Account – With a SEBI-registered broker like Zerodha, Upstox, or ICICI Direct .

- Fund Your Account – Transfer money via UPI, NEFT, or net banking.

- Log in to Your Trading Platform – During market hours (9:15 AM – 3:30 PM).

- Search for Gold BeES – Use the symbol: GOLDBEES or Nifty Gold BeES .

- Place a Buy Order – Choose between market order or limit order.

- Confirm Purchase – Units will reflect in your Demat account the next day.

You can start investing with just a few hundred rupees.

3. Benefits of Investing in Gold BeES

Why choose Gold BeES over traditional gold investments?

- ✅ No Storage Hassle – No need to store or insure physical gold

- ✅ High Purity Guaranteed – Backed by 99.5%+ pure gold

- ✅ Liquidity – Can be sold anytime during market hours

- ✅ Low Entry Cost – Start from the price of 1 unit

- ✅ Transparency – Real-time tracking of holdings and NAV

4. Top Brokers That Offer Gold BeES

Here are some of the best platforms where you can invest in Gold BeES:

| Zerodha | Discount Broker | Low brokerage, user-friendly app |

| Upstox | Online Broker | Free Demat account, fast execution |

| ICICI Direct | Full-Service Broker | Research tools, expert advice |

| HDFC Securities | Bank-Backed | Reliable service, strong support |

All these platforms allow you to trade Gold BeES seamlessly.

5. Taxation on Gold BeES

Gold BeES is taxed like non-equity mutual funds :

- Short-Term Capital Gains (STCG) – If held < 3 years → Taxed at your income tax rate

- Long-Term Capital Gains (LTCG) – If held > 3 years → Taxed at 20% with indexation benefit

This makes them more tax-efficient than physical gold jewelry.

Frequently Asked Questions (FAQs)

Q1: Can I buy Gold BeES without a Demat account?

A: No, Gold BeES is an ETF and requires a Demat & Trading account to invest.

Q2: Is Gold BeES better than digital gold?

A: Yes, for long-term investment due to tax efficiency and purity assurance .

Q3: What is the minimum investment in Gold BeES?

A: You can start with the price of 1 unit, which equals ~₹1–₹2 per gram (based on current gold rates).

Conclusion

Buying Gold BeES is a smart and secure way to invest in real gold digitally—offering liquidity, transparency, and all the benefits of modern investing.