If you’re asking, “How buy gold and silver?” , you’re likely looking for smart ways to diversify your portfolio or hedge against inflation. Both gold and silver are popular precious metals that offer security, liquidity, and long-term value .

1. Understanding Your Investment Options

You can invest in gold and silver in several forms:

- Physical Gold & Silver : Coins, bars, jewelry (for gold only)

- Digital Gold & Silver : Fractional ownership via apps like Paytm Gold, Acredius

- ETFs & Mutual Funds : Gold ETFs like SBI Gold ETF

- Mining Stocks & Funds : Companies involved in extracting gold and silver

- Futures & Options : For advanced investors

Choose based on your goals: wealth preservation, gifting, or growth investing .

2. Step-by-Step: How to Buy Gold and Silver

Here’s how to invest in gold and silver:

For Physical Purchase:

- Choose a trusted seller – e.g., MMTC-PAMP, SBI, HDFC Gold, Amazon India

- Select the form – coins, bars, or jewelry (silver is mainly in coin/bar form)

- Verify purity – look for hallmarking (BIS for India) or LBMA certification

- Make payment – via card, net banking, or cash (for offline stores)

- Get delivery – home delivery or collect from branch

For Digital Purchase:

- Open an account on platforms like Paytm Gold, PhonePe Gold, or Acredius

- Complete KYC

- Select weight and type (gold/silver)

- Make payment via UPI or bank transfer

- Track your holdings in real-time

3. Best Places to Buy Gold and Silver

Here are some of the most trusted sources in India and globally:

| MMTC-PAMP | Physical | BIS-certified gold & silver bars |

| Paytm Gold / PhonePe Gold | Digital | Buy from ₹1; instant ownership |

| Acredius | Digital | Invest in real gold and silver stored securely |

| Amazon India | Physical | Home delivery of certified coins/bars |

| SBI Gold | Physical | Bank-backed, reliable source |

For international investors, platforms like Apmex, JM Bullion, and Fidelity offer secure options too.

4. Things to Consider Before Buying

Before investing in gold and silver:

- ✅ Check current market prices daily

- ✅ Look for hallmarking or certification

- ✅ Be aware of GST (3%) on physical purchases

- ✅ Factor in making charges (for jewelry)

- ✅ Secure storage – locker or insured vault

- ✅ Diversify between gold and silver for better risk management

5. Benefits of Investing in Gold and Silver

Why invest in gold and silver?

- ✅ Hedge Against Inflation – Preserves purchasing power

- ✅ Portfolio Diversification – Reduces volatility

- ✅ Safe Haven Assets – Perform well during economic downturns

- ✅ Liquidity – Easy to convert into cash

- ✅ Affordable Entry – Start with as little as ₹1 via digital platforms

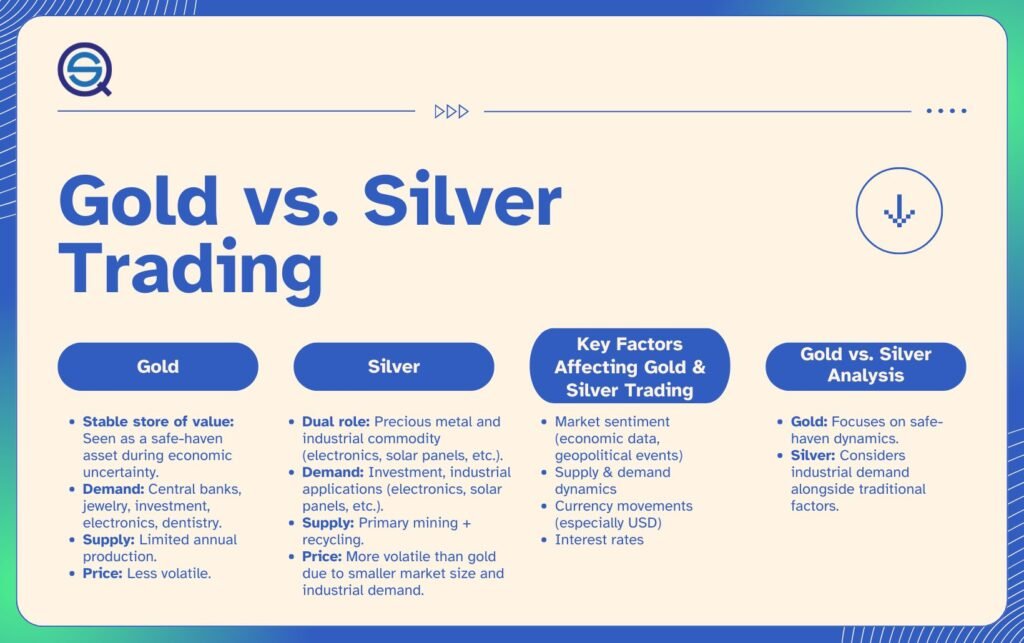

Silver also offers industrial demand , giving it potential for higher growth than gold.

Frequently Asked Questions (FAQs)

Q1: Can I buy silver like gold digitally?

A: Yes, platforms like Acredius allow you to invest in both gold and silver digitally.

Q2: Is silver a good investment like gold?

A: Yes, silver is more volatile but has strong industrial demand and can offer higher returns.

Q3: Do I have to pay GST when buying gold and silver?

A: Yes, a 3% GST applies to the purchase of physical gold and silver in India.