If you’re asking, “How buy gold bond?” , you’re likely looking to invest in Sovereign Gold Bonds (SGBs) — one of the safest and most convenient ways to invest in gold. Issued by the Reserve Bank of India (RBI) on behalf of the Government of India, these bonds are linked to the market price of gold and offer a secure alternative to physical gold.

Let’s walk through a complete guide on how to buy gold bonds in India.

1. What Is a Sovereign Gold Bond (SGB)?

A Sovereign Gold Bond is a government security that allows investors to purchase gold in digital form. Each bond represents 1 gram of 999 purity gold and can be held for a fixed period. You earn returns based on the gold price appreciation and also receive interest income during the holding period.

2. Step-by-Step: How to Buy Gold Bonds (SGBs)

Here’s how to invest in Sovereign Gold Bonds:

- Check Issue Dates – SGBs are issued in tranches by RBI; check the official RBI website or bank notifications.

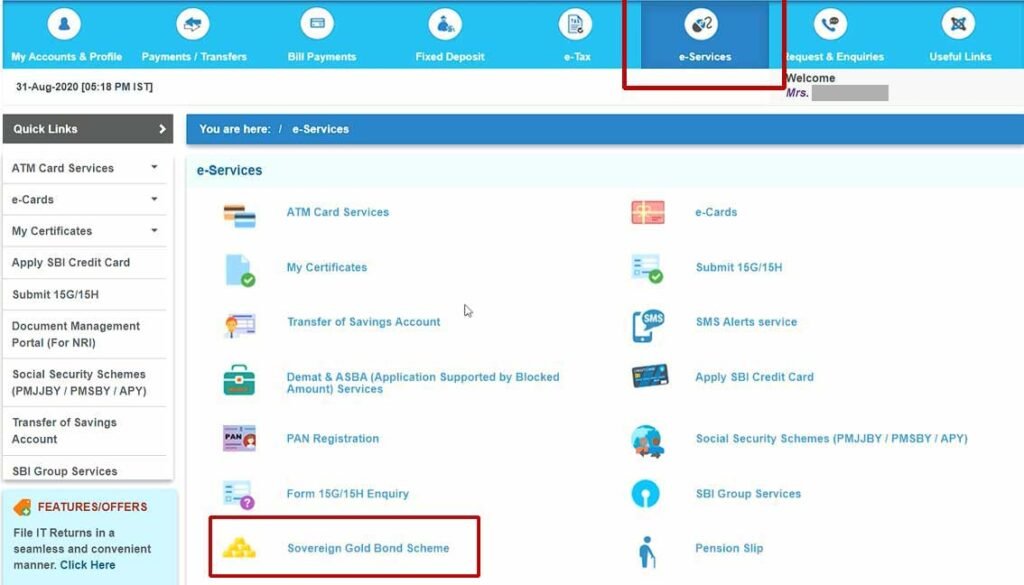

- Open a Demat Account or Use a Bank – You can apply through authorized banks (like SBI, ICICI, HDFC), Post Offices, or through a Demat account.

- Fill Application Form – Available online or at bank branches. Provide PAN, Aadhaar, and bank details.

- Make Payment – Via NEFT, RTGS, UPI, or cheque. You get a discount of ₹50 per gram if paid digitally.

- Receive Allotment – Units are credited to your Demat account or held in book-entry form.

You can invest between 1 gram to 4 kg (individual) per fiscal year.

3. Benefits of Investing in Gold Bonds

Why choose Sovereign Gold Bonds over traditional gold investments?

- ✅ No Purity or Storage Issues

- ✅ Government Guaranteed Returns

- ✅ Earn 2.5% Annual Interest (paid semi-annually)

- ✅ Tax-Free Capital Gains if held till maturity

- ✅ Discount of ₹50/gram for digital payment

- ✅ Collateral for Loans

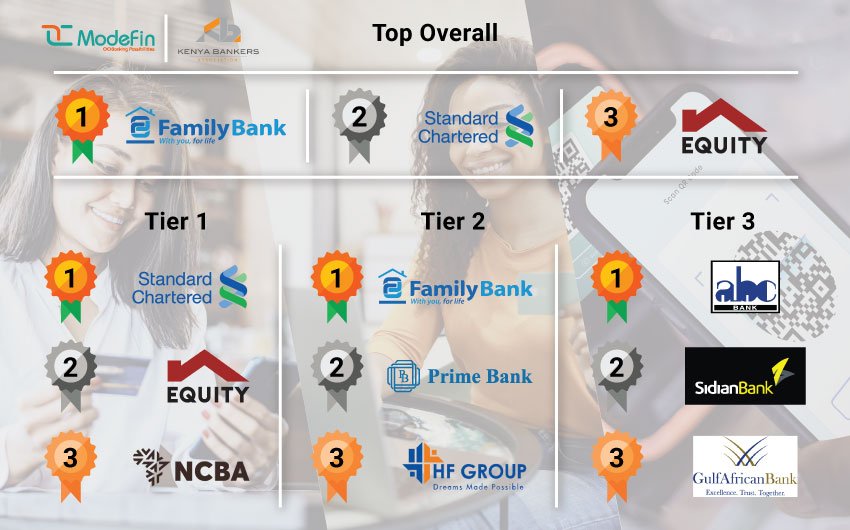

4. Top Banks Offering Gold Bonds in Kenya

Some of the top banks where you can apply for Sovereign Gold Bonds:

| State Bank of India (SBI) | ✅ Yes | ✅ Branch Support |

| ICICI Bank | ✅ Yes | ✅ Yes |

| HDFC Bank | ✅ Yes | ✅ Yes |

| Axis Bank | ✅ Yes | ✅ Yes |

Always ensure you’re applying through official bank portals to avoid fraud.

5. Taxation on Sovereign Gold Bonds

Sovereign Gold Bonds enjoy favorable tax treatment:

- Interest Income – Taxable under “Income from Other Sources”

- Capital Gains on Maturity – Fully tax-exempt

- Early Sale (on Exchange) – LTCG tax applies at 20% with indexation benefit

This makes them more tax-efficient than physical gold or gold ETFs.

Frequently Asked Questions (FAQs)

Q1: Can I buy SGBs online?

A: Yes, through authorized banks like SBI, ICICI, and HDFC via net banking or mobile apps.

Q2: Is there a lock-in period for SGBs?

A: Yes, the tenure is 8 years , with an exit option after 5 years .

Q3: Do SGBs give interest?

A: Yes, you earn 2.5% annual interest , paid semi-annually.

Conclusion

Buying Sovereign Gold Bonds is a smart, secure, and tax-efficient way to invest in gold digitally—offering both returns and government-backed safety.