If you’re wondering “How buy Gold ETF?” , you’ve come to the right place. Gold ETFs (Exchange Traded Funds) are one of the easiest and safest ways to invest in gold without owning physical bullion. They are liquid, secure, and backed by pure gold , making them ideal for both new and experienced investors.

Let’s walk through a step-by-step guide on how to buy Gold ETFs in India.

1. What Is a Gold ETF?

A Gold ETF is a type of mutual fund that tracks the price of gold and is traded on stock exchanges like a regular stock. Each unit typically represents a specific amount of gold (e.g., 1 gram). It gives you exposure to gold prices without the hassles of storage or purity verification.

2. Step-by-Step: How to Buy Gold ETF

Here’s how to invest in Gold ETF:

- Open a Demat and Trading Account – With a SEBI-registered broker like Zerodha, Upstox, or ICICI Direct.

- Link Your Bank Account – For seamless fund transfers.

- Log in to Your Trading Platform – During market hours (9:15 AM to 3:30 PM).

- Search for a Gold ETF – Like SBI Gold ETF, Kotak Gold ETF, or Nippon Gold ETF .

- Place the Order – Choose ‘Buy’ and enter the number of units.

- Confirm and Track – The ETF will reflect in your Demat account the next day.

3. Benefits of Investing in Gold ETF

Why choose Gold ETFs over traditional gold investments?

- ✅ No Storage Hassle – No need to store physical gold

- ✅ High Purity Guaranteed – Backed by 99.5%+ pure gold

- ✅ Liquidity – Can be sold anytime during market hours

- ✅ Low Entry Cost – Start with just a few hundred rupees

- ✅ Tax Efficiency – Long-term capital gains tax benefits if held over 3 years

4. Best Gold ETFs in India

Some of the most popular and trusted Gold ETFs in India include:

| SBI Gold ETF | 0.50% | 1 gm of gold |

| Kotak Gold ETF | 0.45% | 1 gm of gold |

| Nippon India Gold ETF | 0.60% | 1 gm of gold |

| HDFC Gold ETF | 0.50% | 1 gm of gold |

Choose based on performance, expense ratio, and liquidity.

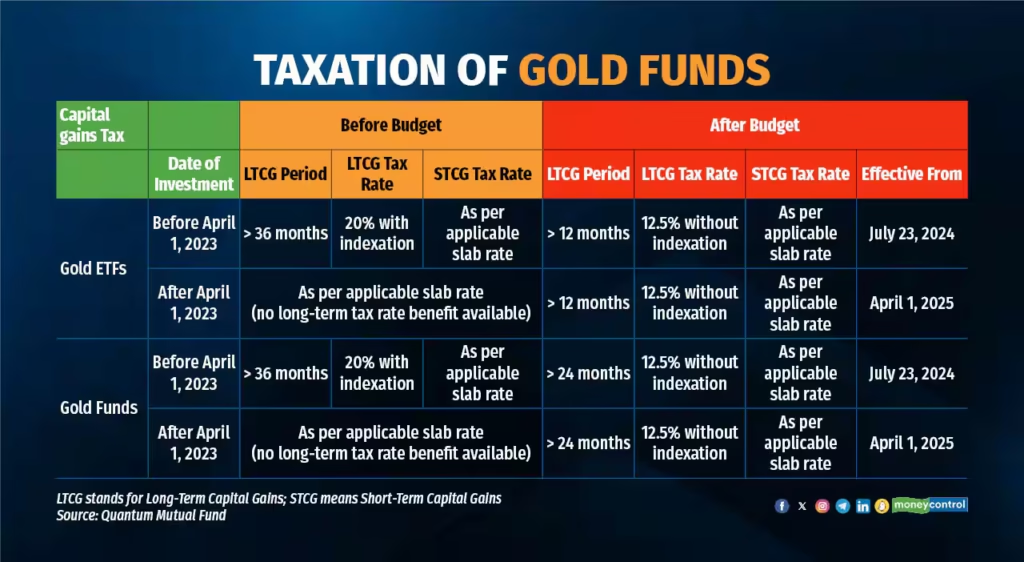

5. Taxation on Gold ETFs

Gold ETFs are taxed like non-equity mutual funds :

- Short-Term Capital Gains (STCG) – If held < 3 years → Taxed at your income tax slab rate

- Long-Term Capital Gains (LTCG) – If held > 3 years → Taxed at 20% with indexation benefit

This makes them more tax-efficient than physical gold or gold jewelry.

Frequently Asked Questions (FAQs)

Q1: Can I buy Gold ETF without a Demat account?

A: No, Gold ETFs are listed on exchanges and require a Demat & Trading account.

Q2: Is Gold ETF better than digital gold?

A: Yes, for long-term investment, due to tax efficiency and purity assurance.

Q3: What is the minimum investment in Gold ETF?

A: You can start with the price of 1 unit, which equals ~₹1–₹2 per gram (based on current gold rates).

Conclusion

Buying Gold ETF is simple, safe, and smart—it lets you invest in real gold digitally with all the benefits of modern investing.